As a key piece of equipment in the material sorting field, wind sifter leverage the principles of airflow dynamics to separate light and heavy materials. They have evolved from simple air duct devices into a core tool supporting the upgrading of multiple industries. Amidst surging demand for solid waste resource utilization, agricultural quality improvement, and industrial purification, wind sifter continue to achieve breakthroughs in technical parameter optimization, structural innovation, and application-specific adaptability, fostering a development landscape characterized by "high-end leadership and regional differentiation." However, challenges remain, such as the difficulty in sorting materials of similar density and the technical weaknesses of small and medium-sized enterprises. Examining these current and future trends is of great practical significance for promoting the efficient development of a circular economy.

Current Status of Technological Development: Breakthroughs in Multiple Fields and System Upgrades

1. Core Technical Parameters and Structural Optimization

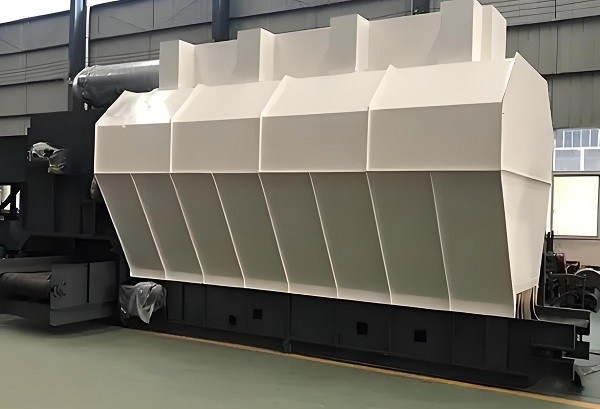

In terms of technical parameter iteration, current mainstream wind sifter have made the leap from "extensive sorting" to "precise control." For example, the AS1400, a model with a high market share, utilizes a centrifugal fan and a tapered air duct design, maintaining a stable air volume capacity of 30,000 m³/h. Combined with a variable-speed feeder, the unit's processing capacity can be flexibly adjusted between 30 and 45 tons/hour depending on material characteristics. A pre-screening device precisely controls the feed particle size to within 80 mm, effectively preventing damage to the separation chamber caused by large particles. In terms of structural design, a standardized modular system has become an industry consensus. The entire equipment consists of a sealed feed module, a multi-stage sorting chamber, and a dual cyclone and bag collection system. The sorting chamber innovatively utilizes a stepped airflow distribution plate. A PLC control system adjusts key parameters such as feed speed (0.5-2m/s), air blowing angle (30°-60°), and air pressure (5-15kPa). This enables precise separation of lightweight materials with densities below 1.2g/cm³, such as plastics, paper scraps, and wood chips, with a typical separation efficiency exceeding 80%. Leading companies are particularly innovative in their technology. Their groundbreaking internal recirculation airflow design recirculates the dust-laden airflow generated during the sorting process through a closed-loop duct back to the fan inlet. Combined with a high-efficiency pulse dust collector, this keeps dust emission concentrations strictly below 10mg/m³, far below the 30mg/m³ limit stipulated in the "Comprehensive Emission Standards for Air Pollutants." The use of dual-frequency fans dynamically matches air volume and pressure, reducing energy consumption by 40% compared to traditional fixed-frequency models, with a single unit saving up to 12,000 kWh of electricity annually.

2. A multi-scenario application landscape is taking shape

In the solid waste treatment sector: wind sifter have become core sorting equipment for the resource utilization of solid waste, including household and construction waste, playing a pivotal role in the "pretreatment - sorting - resource recovery" industry chain. The comprehensive domestic waste treatment project utilizes a "drum screening + air separator" process. This process uses an air separator to precisely separate plastic film and paper packaging from kitchen waste, increasing the proportion of recyclables sorted from 22% with traditional methods to over 35%, and increasing the recycling revenue by over 80 yuan per ton of waste. The construction waste recycling demonstration project innovatively employs a three-stage air separation process: the first stage removes lightweight wood chips and plastics, the second stage separates gypsum from lightweight aggregates, and the third stage purifies recycled aggregates. Ultimately, this process stabilizes the lightweight material recovery rate at 85%, with a recycled aggregate purity of 98%. The project processes over 2 million tons of construction waste annually.

Agriculture and Industry: In agriculture and animal husbandry, long-sieve wind sifter, with their combined advantages of "vibration conveying + airflow separation," have become the primary equipment for grain cleaning and feed grading, accounting for 53% of the market. In the major corn-producing areas of Northeast China, this equipment effectively removes moldy particles and straw impurities from corn, achieving a cleaning efficiency of 99%, reducing grain storage losses by 3 percentage points. Industrial market segments are rapidly expanding. Dedicated wind sifter for photovoltaic silicon material grading require fine separation of silicon material particles with a diameter of 0.1-3mm, significantly raising the technical threshold. The market size is expected to grow by 43.2% year-on-year in 2023, with tenders for related equipment accounting for 61.7% of the national total. These machines primarily utilize an inert gas-protected separation chamber design to prevent oxidation loss of silicon material.

Regional Market Differentiation: Influenced by industrial foundations and policy guidance, the regional market for wind sifter exhibits significant differentiation. East China, leveraging the Yangtze River Delta solid waste treatment industry cluster and high-end manufacturing infrastructure, and North China, benefiting from the Beijing-Tianjin-Hebei region's construction waste management policies, contribute a combined 55% of national market demand. Equipment purchase prices are generally 15%-20% higher than the national average, with a preference for intelligent, high-end models. Northwest and Southwest China, benefiting from policies promoting specialized agricultural development, are experiencing rapid growth in the air separator market, driven by demand for cotton cleaning in Xinjiang and traditional Chinese medicinal herb sorting in Yunnan. The market has achieved a compound annual growth rate of 13.8% over the past three years, primarily in small and medium-sized, economical equipment.

3. Existing Technical Bottlenecks

The core technical pain point lies in insufficient material compatibility. For materials with a density difference of less than 0.3g/cm³ (such as PP and PE plastics, rubber granules, and lightweight wood chips), a single-stage air separation process can only achieve a purity of 75%-80%, necessitating the use of multi-stage separation or auxiliary technologies, which doubles equipment investment and energy consumption. Moisture sensitivity is also a prominent issue. When the moisture content of the material exceeds 15%, particles tend to agglomerate, narrowing the effective range of airflow separation and reducing equipment processing efficiency by over 25%. This is particularly pronounced in rainy southern regions or for food waste disposal, requiring pre-drying equipment, which increases system complexity.

Future Development Trends: Intelligent and Ecological Upgrades

1. Deep Penetration of Intelligence

AI and IoT technologies are shifting from "auxiliary functions" to "core drivers," reshaping the operation and management of wind sifter. The newly launched intelligent air separation system utilizes 12 sets of pressure sensors and infrared material detectors deployed in the separation chamber to collect real-time data on airflow velocity, material distribution, and other factors. After analysis by the edge computing module, it automatically adjusts the fan frequency and feed rate, ensuring optimal operation at all times. This reduces fault response time from the traditional two hours to within 15 minutes, reducing overall energy consumption by 18%. Cutting-edge technological applications have achieved a closed loop of "perception-decision-execution." AI-powered air sorters integrate multispectral recognition cameras and deep learning algorithms, enabling multi-dimensional identification of materials based on color, shape, and density. They automatically switch sorting parameters for different materials, such as plastics, rubber, and paper, increasing sorting accuracy to 92%, a 15 percentage point improvement over traditional equipment. Industry associations predict that with the widespread adoption of industrial internet platforms, the market share of intelligent air sorting equipment will exceed 45% by 2025, with cloud-based remote operation and maintenance reaching 76.8%, enabling full lifecycle management, including equipment failure warnings and consumable lifecycle predictions.

2. Green and Collaborative Development

Energy-saving technological breakthroughs: Energy conservation and consumption reduction have become core priorities for the company's technological research and development. Low-power vibration motors, by utilizing rare earth permanent magnets and optimizing electromagnetic structures, reduce energy consumption by 23%-27% compared to traditional asynchronous motors, reducing the annual operating cost of a single unit by nearly 10,000 yuan. Screen material upgrades have also yielded significant results. New polyurethane composite screens, with their wear and corrosion resistance, boast a service life exceeding 18,000 hours, three times that of traditional stainless steel screens. This shortens the equipment replacement cycle from 5-7 years to 3-4 years, indirectly reducing carbon emissions over the equipment's entire lifecycle. Furthermore, waste heat recovery technology has begun to be applied in large-scale air separation systems. This utilizes the waste heat generated by the airflow during the separation process for material preheating or workshop heating, achieving cascaded energy utilization.

Combined separation becomes mainstream: The limitations of single air separation technology are driving the industry toward a multi-technology integration approach. Combined separation systems have become the preferred solution for high-value resource recovery projects. Solid waste treatment projects utilize a three-stage integration model of "magnetic separation + air separation + eddy current separation." Magnetic separation first removes ferromagnetic materials, followed by air separation to separate lightweight materials, and finally eddy current separation to recover non-ferrous metals. This results in an overall resource recovery rate exceeding 90%, a 25% improvement over air separation alone. In the renovation waste treatment sector, a combined "air separation + optical sorting" technology is innovatively applied. Air separation first removes lightweight dust and paper, while optical sorting uses AI to precisely separate different types of plastics, achieving a 98% plastic purity for direct use in recycled pelletizing.

3. Market and Policy-Driven Expansion

Strong policy support has injected momentum into the industry's development. Intelligent sorting machinery has been specifically included in the key support list. Funding for air separation machines and other sorting equipment in the central agricultural machinery purchase subsidy budget has increased by 12% year-on-year. Some provinces have also added an additional 10%-15% in local subsidies, significantly reducing procurement costs for agricultural users. Ecological and environmental protection policies are also being strengthened. Pilot projects for "Zero Waste Cities" have been launched in over 100 cities nationwide, requiring a recycling rate of at least 35% for domestic waste. This has directly driven a surge in demand for air separation equipment, with the domestic air separation equipment market projected to exceed 20 billion yuan by 2030.

Emerging market demands are accelerating industry expansion. In the lithium battery recycling sector, the peak in power battery retirements is driving strong demand for the separation of tab metal and diaphragm materials, driving an average annual growth rate of 28.6% in the market for specialized air separation machines. These machines must meet special requirements such as high-temperature resistance (above 60°C) and corrosion resistance, resulting in a price tag over 50% higher than conventional models. In the international market, following the entry into force of the RCEP agreement, imports of air separation machines from China by ASEAN countries, driven by the need to upgrade solid waste treatment infrastructure, saw a 312% year-on-year increase. Customized models designed for Southeast Asia's hot and humid climates have become a new growth area. These machines feature stainless steel bodies and moisture-proof motors, enabling stable operation in humidity levels above 80%.

4. Optimizing Industry Competition

The current air separator market features a competitive landscape characterized by concentrated market share among leading companies and fragmented market share among small and medium-sized enterprises. Leading companies, leveraging their technological advantages, hold over 40% of the high-end market share, maintaining a gross profit margin of 25%-30%. Small and medium-sized enterprises, however, focus on regional markets or niche sectors, specializing in small agricultural wind sifter, with a 20% market share in the southwest Chinese medicinal material sorting market. Industry consolidation is accelerating, with five mergers and acquisitions exceeding 100 million yuan expected in 2023. Leading companies are acquiring small and medium-sized enterprises to expand their presence and acquire patents, further consolidating their market position. Furthermore, industry-university-research collaboration is deepening, with universities and businesses jointly establishing R&D centers to focus on core technologies such as sorting materials of similar density and low-energy airflow control, driving overall technological advancement in the industry.

Air separators have evolved from simple mechanical sorting equipment to intelligent systems integrating multiple technologies: mechanics, electronics, and AI. They have established irreplaceable core value in multiple fields, including solid waste resource utilization, agricultural quality improvement, and industrial purification. While currently facing challenges such as insufficient material compatibility and technological weaknesses among small and medium-sized enterprises, the industry is accelerating its transformation towards high efficiency, low carbon, and precision, driven by the deep penetration of intelligent technology, the continued strengthening of green development policies, and the growing demand from emerging markets. In the future, wind sifter will not only become a key hub in the circular economy industry chain but will also play a vital supporting role in achieving the "dual carbon" goals, promoting the synergistic improvement of resource utilization efficiency and ecological and environmental benefits.

From parameter optimization to intelligent integration, the technological evolution of wind sifter demonstrates the deep alignment between equipment manufacturing and ecological needs. Intelligent upgrades have solved the problem of precise sorting, green collaborative models have broadened the scope of application, and the dual driving forces of policy and market forces have opened up further growth opportunities. While key technological breakthroughs and industrial structure optimization still require significant effort, with the deepening integration of industry, academia, and research, and the development of emerging scenarios, wind sifter will undoubtedly shoulder a greater role in the resource recycling system, providing solid equipment support for the realization of the "dual carbon" goals and the low-carbon transformation of the industry.